Navigation auf uzh.ch

Navigation auf uzh.ch

May 20, 2021

What Role for Finance in Climate Mitigation Scenarios?

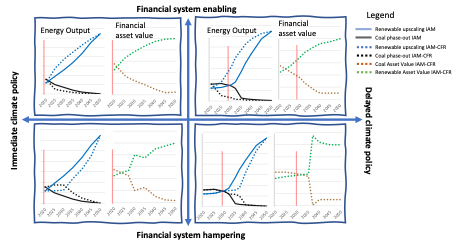

A new study by Stefano Battiston (UZH) and coauthors from WU Vienna and IIASA show how climate mitigation scenarios can be improved by taking into account that the financial system can play both an enabling or a hampering role on the path to a sustainable economic system.

Battiston, S., Monasterolo, I., Riahi, K., van Ruijven, B. (2021). Accounting for finance is key for climate mitigation pathways. Science DOI: 10.1126/science.abf3877

Limiting global warming: a concern also for financial authorities. To limit global warming, a profound transformation of energy, production and consumption in our economies is required. The scale of the transformation means that the financial system must have a proactive role. New green investments are needed, as well as a reallocation of capital from high to low-carbon activities. The Central Banks and Supervisors Network for Greening the Financial System (NGFS), of which the Swiss National Bank is a member, was recently established with the aim of better understanding and managing the financial risks of climate change.

Climate mitigation scenarios. Climate mitigation scenarios are key to understanding the transition to a low-carbon economy and inform climate policies. The climate mitigation scenarios developed by the NGFS in collaboration with the Intergovernmental Panel on Climate Change of the United Nations (IPCC) have been a major step in providing financial actors with forward‑looking views on how low and high-carbon economic activities could evolve over the next decades. However, at this stage, these scenarios are based on large-scale Integrated Assessment Models (IAMs) that do not take into account the dynamic nature of the financial system and its actors.

Why finance's risk perception impacts on scenarios. Not only scenarios impact on finance, but also the risk perception of the financial system from the scenarios can change the scenarios themselves. This is because they are endorsed by many influential central banks and financial authorities in the world, as well as by large investors. This feedback loop is currently not considered in the models. But it can changes things fundamentally. Under some conditions, this could also lead to an underestimation of risk across mitigation scenarios and trajectories of orderly and disorderly transition. This presents an opportunity to interface IAMs with models that allow investors to carry out climate-financial risk assessments (CFRs).

Click here to go to the article

Policy implications. The framework could support financial authorities in encouraging investors’ assessment of climate-related financial risk. The new IAM-CFR scenarios would limit the underestimation of financial risk in climate stress-test exercises. Accounting for the role of the financial system also has implications for criteria used by central banks to identify eligible assets in their collateral frameworks and purchasing programs. Furthermore, our results shed light on the importance for financial authorities to monitor and tame the possible moral hazard of the financial system in the dynamics of the low-carbon transition.

Correspondence e-mail: stefano.battiston (at) uzh.ch

Affiliations of the team of authors

Stefano Battiston 1, 2, Irene Monasterolo 3, 4, Keywan Riahi 5, 6, Bas J. van Ruijven 5

1. Dept. Banking and Finance, University of Zurich, Zurich, Switzerland.

2. Dept. of Economics, Ca’ Foscari University of Venice, Venice, Italy.

3. Vienna University of Economics and Business, Vienna, Austria.

4. Global Development Policy Center, Boston University

5. International Institute for Applied Systems Analysis (IIASA)

6. Graz University of Technology, Graz, Austria.