Navigation auf uzh.ch

Navigation auf uzh.ch

BigDataFinance Winter School on

Complex Financial Networks

09.01.2017 – 13.01.2017, University of Zurich, Switzerland

Click here to view impressions (pictures) of the Winter School

Aims and Scope of the Winter School

The ability to manage and process massive and heterogeneous data is crucial for financial institutions and regulators in order to successfully manage both individual risk as well as systemic risk. Nonetheless, financial research and training has been slow in addressing the BigData revolution.

The BigDataFinance Winter School aims to fill this gap within by providing participants with state-of-the-art knowledge and practical tools on financial networks and applications for both risk management and policy.

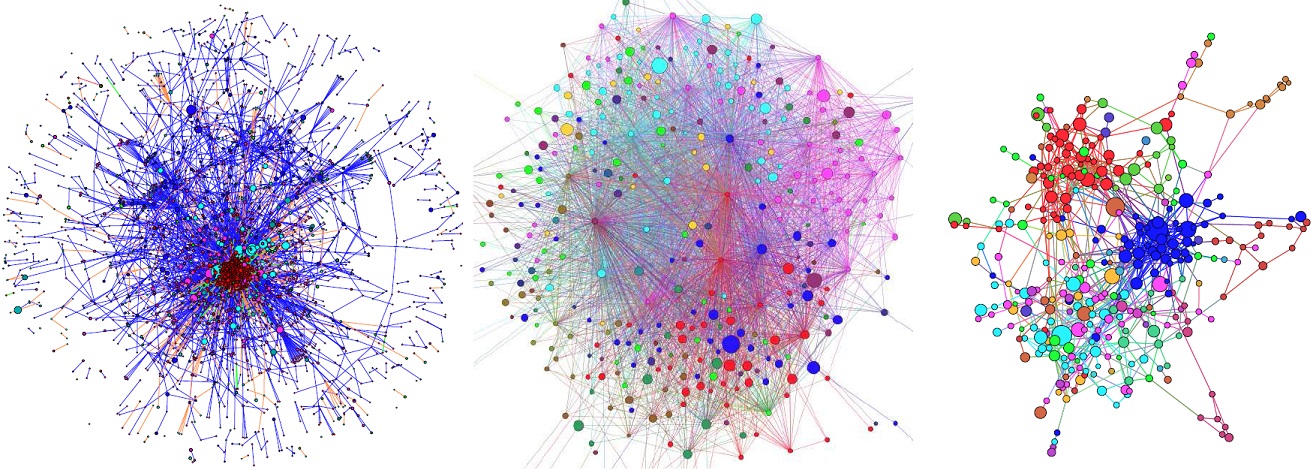

The school covers the recent developments in the growing field of the Financial Networks, from the perspective of BigDataFinance, Systemic Risk and Sustainability. The school will provide introductory lectures to financial network analysis as well as more advanced lectures on network models of financial contagion and systemic risk. Several tutorials will focus on software tools for network analysis and visualization. Other tutorials will focus extracting information from financial network datasets. Participants will be able to attend a two-day, international conference on Financial Networks organized by the FINEXUS Center, including a high level panel discussion event.

The BigDataFinance Winter School is part of the EU Marie Skłodowska-Curie Research Fellowship Programme BigDataFinance. However, we are also happy to consider submissions from external participants.

Tuition Fees are 200 CHF for external participants (no fees for MC PhD Fellows). Accommodation and travel costs are not covered by the organizers. Successful applicants will receive a confirmation and further instructions via email.

Venue: Room AND-4.06, Andreasstrasse 15, Building AND, 8050 Zürich

Timeframe: 09.01.2017 – 13.01.2017

Organisers:

Professor Stefano Battiston, University of Zurich

Professor Juho Kanniainen, Tampere University of Technology, BigDataFinance Coordinator

![]()

![]() Agenda

Agenda

BDF = Big Data Finance School “Complex Financial Networks”

MC = Marie Sklodowska-Curie Research Fellowship Programme

Winter School students: please see note at the bottom of this page

|

Monday, 9 January 2017 - Venue: Room 406, Andreasstrasse 15, Building AND, 8050 Zurich |

||||

|

08:30 – 10:00 |

BDF lectures: Introduction to financial networks, Stefano Battiston (UZH) |

|||

|

10:00 - 10:30 |

Coffee break |

|||

|

10:30 – 13:00 |

BDF lectures: Credit valuation adjustments by a network-based methodology, Sumit Sourabh (ING) |

|||

|

13:00 – 14:00 |

Lunch |

|||

|

14:00 – 16:00 |

BDF tutorials: Network Analysis and Visualization Tools (Orbis, Neo4j, Gephi, Matlab), James Glattfelder (UZH), Borut Sluban (UZH) |

|||

|

16:00 - 16:30 |

Coffee Break |

|||

|

||||

|

Tuesday, 10 January 2017 - Venue: Room 406, Andreasstrasse 15, Building AND, 8050 Zurich |

||||

|

08:30 – 10:00 |

BDF lectures: Investor networks in stock markets, Juho Kanniainen (TUT) |

|||

|

10:00 - 10:30 |

Coffee break |

|||

|

10:30 – 13:00 |

BDF tutorials: Blockchain technologies for financial markets, Richard Olsen (Lykke AG and OLSEN Ltd), Anton Golub (Lykke AG and OLSEN Ltd), Daniel Gasteiger (nexussquared) |

|||

|

13:00 – 14:00 |

Lunch |

|||

|

14:00 – 16:00 |

BDF Tutorials: Network based stress testing, Stefano Battiston (UZH), Paolo Barucca (UZH) |

|||

|

16:00 - 16:30 |

Coffee break |

|||

|

||||

|

20:00 |

BDF social dinner |

|||

|

Wednesday, 11 January 2017 - Venue: Aula, KOL-G-201, Rämistrasse 71, 8006 Zürich |

||||

|

10:00-10:30 |

Welcome Coffee |

|||

|

10:30-10:45 |

Introductory remarks: Stefano Battiston (UZH) |

|||

|

Session 1. Valuation, Contagion, and Endogeneity in Financial Networks |

||||

|

10:45-13:00 |

Mauro Napoletano (OFCE-Sciences Po): Collateral Unchained: Rehypotecation networks, complexity and systemic effects Marco D’Errico (UZH): Rethinking Financial Contagion Paolo Barucca (UZH): Network Valuation in Financial Systems |

|||

|

13:00-14:00 |

Lunch |

|||

|

Keynote Session |

||||

|

14:00-15:00 |

Lucas Bretschger (ETH Zurich): Sustainability, Risk, and Climate Policy: The Long-Run Perspective. |

|||

|

Session 2. Climate Policies and Climate-finance Networks |

||||

|

15:00-17:00

|

Marc Chesney (UZH): Mitigating Global Warming: A Real Options Approach Antoine Mandel (Paris School of Economics, University Paris 1 Panthéon-Sorbonne): A climate stress-test of the financial system Veronika Stolbova (UZH): The climate-finance EA macro-network: mapping the exposure of the financial system to climate policy risks |

|||

|

17:00 - 17:30 |

Coffee Break |

|||

|

Session 3. Financial Networks and Civil Engagement on Sustainability |

||||

|

17:30-19:30 |

Giulia Porino (Finance Watch): Citizens Dashboard of Finance Franziska Schütze (Global Climate Forum) and Hamza Zeytinoglu (Bosforus Univ.): Policy Network Maps Crowdsourcing |

|||

|

17:30-19:30 |

Parallel Session - Marie-Curie fellows’ presentations III (Room: KOL-G-209) |

|||

|

Thursday, 12 January 2017 - Venue: Aula, KOL-G-201, Rämistrasse 71, 8006 Zürich |

||||

|

Session 4 (General public). Finance and sustainability: what role for civil society? Panel session with final discussion |

||||

|

08:30-10:30 |

Antoinette Hunziker-Ebneter (Forma Futura Invest AG): Nachhaltigkeit in der Finanzindustrie – Utopie oder Realität Prof. Anton Gunzinger (ETH and Supercomputing Systems): Erneuerbare Energie (in German) Katharina Serafimova (WWF): tba Thierry Philipponnat (Institut Friedland): The Role of Civil Society in Holding Financial Powers Accountable Jared Bibler (Katla AG): Globalized market abuse: the example of Iceland |

|||

|

10:30-11:00 |

Coffee break |

|||

|

11:00-13:00 |

Marc Chesney (UZH): Financial Innovation and Systemic Risks Stefano Battiston (UZH): Rethinking Sustainable Finance Panel Discussion |

|||

|

13:00-14:00 |

Lunch |

|||

|

Keynote Session |

||||

|

14:00-15:00 |

Rama Cont (Imperial College): Systemic stress testing, fires sales and indirect contagion. |

|||

|

Session 5. Estimating Financial Networks and Systemic Risk with limited information. Chairman: Guido Caldarelli (IMT). |

||||

|

15:00-16:30 |

Luitgard Veraart (LSE): Adjustable Network Reconstruction with Applications to CDS Exposures. Tiziano Squartini (IMT): Reconstructing economic and financial networks Giulio Cimini (IMT): Statistically validated network of portfolio overlaps and systemic risk. |

|||

|

16:30-17:00 |

Coffee break |

|||

|

Session 6. Public Round Table. Disentangling the Finance-Climate-Inequality Nexus. |

||||

|

17:30-19:30 |

Hosting: Nobel Laureate Prof. Joseph Stiglitz (Columbia Univ.), Thierry Philipponnat (Institut Friedland), Sony Kapoor (Re-Define). Moderator: Katharina Serafimova. Click here to see a video recording of the public round table session. |

|||

|

Friday, 13 January 2017 - Venue: Aula, KOL-G-201, Rämistrasse 71, 8006 Zürich |

||||

|

Keynote Session |

||||

|

09:00-10:00 |

Franklin Allen (Imperial College): Financial Networks and Systemic Risk |

|||

|

Session 7. Over the Counter markets: insights from network theory. Chairman Kjell Nyborg (UZH) |

||||

|

10:00-10:50 |

Marco D’Errico (UZH): How does risk flow in the Credit Default Swap market? Tarik Roukny (Univ. of Ghent): Compressing over-the-counter markets. |

|||

|

10:50-11:20 |

Coffee Break |

|||

|

11:20-13:00

|

Marc Chesney (UZH): Complexity of Structured Products Inaki Aldasoro (BIS): Multiplex interbank networks and systemic importance: an application to European data Christoph Aymanns (LSE): Illiquidity Spirals in Over-the-Counter Repo Markets Kartik Anand (Deutsche Bundesbank): General discussion of Session 7 |

|||

|

13:00-14:00 |

Lunch |

|||

|

Keynote Session |

||||

|

14:00-15:00 |

Joseph Stiglitz (Columbia Univ.): The Price of Complexity in Financial Networks |

|||

|

Session 8. Policy Applications of Financial Networks. Chairman Stefano Battiston (UZH) |

||||

|

15:00-15:40 |

Grzegorz Hałaj (ECB): ABM of systemic liquidity risk. Kartik Anand (Deutsche Bundesbank): Capturing information contagion in a stress-testing framework |

|||

|

15:40-16:10 |

Coffee Break |

|||

|

16:10-16:50 |

Peter Sarlin (Hanken School of Economics and RiskLab Finland): RiskRank: Measuring interconnected risk. Fabio Caccioli (UCL): Pathways towards instability in financial networks |

|||

|

Session 9. Conference Concluding Remarks |

||||

|

16:50-18:00 |

Stefano Battiston (UZH), Marc Chesney (UZH) |

|||

|

18:00-19:00 |

Marie-Curie fellows’ presentations IV |

|||

Notes for Winter School Students:

Lunch on Mon and Tue: served in UZH Mensa Oerlikon, Binzmühlestrasse 14

Lunch on We, Th and Fr: Brown Bag Lunch at Zentrum UZH (Main Building), Rämistrasse 71

School social dinner: Tuesday, 10 January at 20:00, venue Le Dézaley, Römergasse 7+9